Growth Consulting

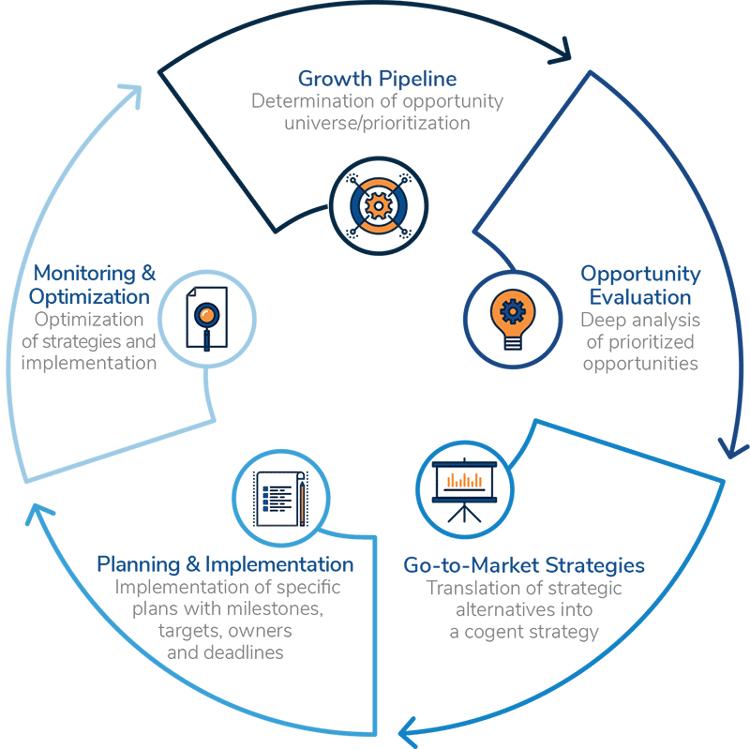

Frost & Sullivan’s Growth Consulting Model provides specific tools and expertise to support clients through all five phases of the growth cycle: From developing a pipeline of growth opportunities to evaluating and prioritizing those opportunities to formulating and implementing go-to-market strategies to ongoing monitoring.

Growth Consulting Model

Contact Us

Have Questions?

We have Answers.

Schedule a Complimentary Growth Strategy

Dialogue with an Industry Expert

877.GoFrost (877.463.7678) |

myfrost@frost.com |

|