Is your company prepared for the coming transformation?

Join the Transformational Growth Journey Powered by the

Growth Pipeline Engine

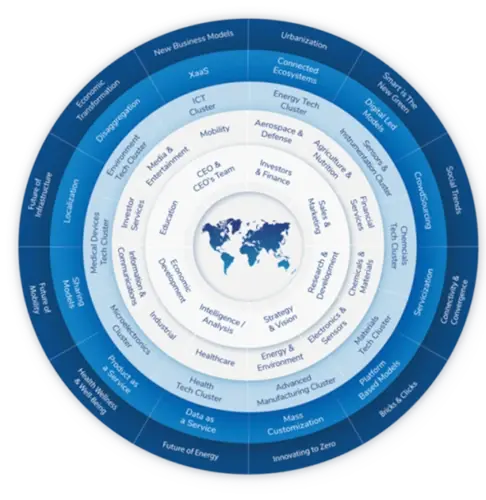

Growth Opportunities

Identify new Growth Opportunities

Where will your growth come from?

Where will your growth come from? Are you tracking Growth Opportunities in new geographies, technologies, and industries?

Are you tracking Growth Opportunities in new geographies, technologies, and industries? Which Megatrends are reshaping your competitive landscape?

Which Megatrends are reshaping your competitive landscape? How are customer preferences changing & reshaping your industry?

How are customer preferences changing & reshaping your industry? Do you understand what drives & restrains future industry opportunities?

Do you understand what drives & restrains future industry opportunities?

Growth Generator

Frost & Sullivan's Growth Analytics Team

10x more cost-effective than building in-house client intelligence teams

10x more cost-effective than building in-house client intelligence teams 10x more impact leveraging Frost & Sullivan’s deep industry expertise

10x more impact leveraging Frost & Sullivan’s deep industry expertise Full time analysts drive growth by identifying trends, technologies, and models

Full time analysts drive growth by identifying trends, technologies, and models

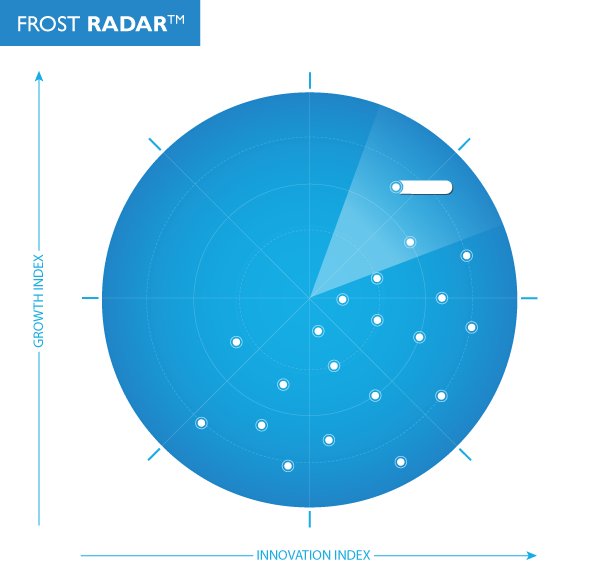

Frost Radar™

The Frost Radar™

Our work is focused exclusively on identifying the Growth Opportunities of the future and evaluating companies that are best positioned to take advantage of them. The Frost Radar™ is a robust analytical tool that allows us to evaluate companies across two key indices: their focus on continuous innovation and their ability to translate their innovations into consistent growth. Our primary and secondary analyses span the entire value chain of each industry, identifying organizations that consistently develop new growth strategies based on a visionary understanding of the future and a proven ability to effectively address emerging challenges and opportunities.

In that vein, the Frost Radar™ serves as a truly dynamic solution to continuously benchmark companies’ future growth potential with clear insight into their core strengths and weaknesses.

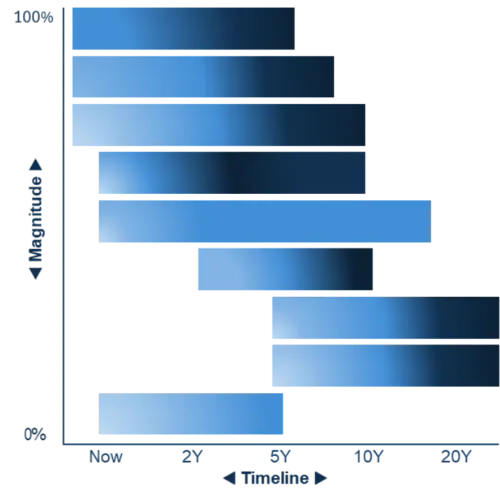

Transformation

Frost & Sullivan's Growth Analytics Team

Understand Transformation impacting your industry – by business lines & in all geographies

Understand Transformation impacting your industry – by business lines & in all geographies Understand the timeline of the impact, when it begins, and how long it lasts

Understand the timeline of the impact, when it begins, and how long it lasts Understand the impact curve – linear, exponential, etc.

Understand the impact curve – linear, exponential, etc. Understand the magnitude of impact on your business

Understand the magnitude of impact on your business Understand Growth Opportunities and Companies to Action arising from these Transformations

Understand Growth Opportunities and Companies to Action arising from these Transformations

Contact Us

Message us below.

Our Offices

Email us or call us

AFRICA

Europe

+44 (0)20 3310 1200

Japan

+81 50-6875-0901

Middle East & North Africa

+971.4.433.1893

South Asia

+91 (0) 22 6160 6666

Asia Pacific

Israel

+972-9.950.2888

Latin America

+54 11 5128 8674